An understanding of the Harmonized System is essential for importers and exporters alike!

Proper classification is a regulatory requirement under the Customs Modernization Act and export control regulations. This program is ideal for new staff, a refresher for seasoned staff, or for those involved in determining eligibility for Free Trade Agreements.

At the end of this training, you will understand…

- • the Harmonized Systems and when to use the Harmonized Tariff or Schedule B.

- • the General Rules of Interpretation, General Notes, and Trade Preference Provisions used to correctly classify your imports for advantageous duty rates.

- • how product modification, trade agreements, and preference programs can reduce duty paid.

- • how to obtain rulings from the government.

- • what tools are available to help with classification.

- • how to avoid fines, penalties, overpayment of duties, and other compliance problems.

No cost to attend. Registration is required.

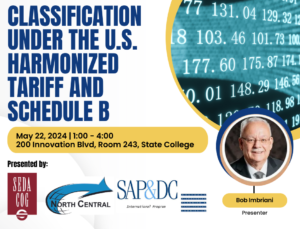

200 Innovation Blvd.

Room 243

State College, PA

Registration fee includes snacks, refreshments, course materials, and certificate.

Deadline to register May 15